With the markets plunging, and financial panic spreading, things can sure start feeling like 2008. Many experts say the current downturn is not just about the Corona pandemic. Something weird is happening with debt and liquidity making the markets go haywire, a la 2008.

In an ironic coincidence, this week is the anniversary of The Big Short, Michael Lewis’ blockbuster book-turned-movie, which came out 10 years ago. It told the *real* story of the 2008 crash: How a small group of little known and brilliant Wall Street insiders invented a short strategy that triggered a global economic meltdown.

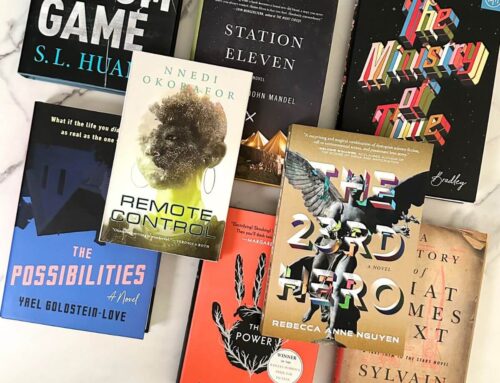

So it seems like the perfect time for a Big Short roundup: A list of titles – both classics and new – about economic crises, who survives, who gets sucked under, and what might cause – or be causing right now – the next financial crash.

And since economic plight is not exclusively about bear markets, Wall Street and global “crashes,” but rather includes the fortunes of individuals and groups determined by race, class and gender, the list also has titles touching on this alternate perspective of boom and bust.

Make sure to order your copy of Greedy Heart by A.P. Murray now, called a most anticipated book of 2020 by SheKnows!

The House of Mirth by Edith Wharton

Many have said the 2000s ushered in a New Gilded Age. Like the Gilded age of the 1900s, this epoch characterized by a huge discrepancy between rich and poor.

Reminder: The first Gilded Age culminated the Great Depression.

The House of Mirth takes us back to that first Gilded Age. The reflections of the heroine, Lily Bart, in her descent from wealth into penury are some of the greatest observations on money ever made.

Selden: “The only way to not think about money is to have a great deal of it.”

Lily: “You might as well say that the only way not to think about air is to have enough to breathe.”

House of Debt by Atif Mian & Amir Sufi

The 2008 crash woke the world to the fact that banks were on the hook for debts they couldn’t pay.

Now, consumer debt has grown large enough to jeopardize the economy. Household debt is higher than ever before—which will make recessions worse than ever before. In order to prevent, or lessen the consequences of, the next Great Recession, the House of Debt authors argue we must address our constant indebtedness and the system that causes it, in which lenders and creditors—not the average person— hold all the power.

Because individual consumers are not “too big to fail.”

Anna Karenina by Leo Tolstoy

Sometimes it seems Tolstoy is an economist masquerading as a novelist. Anna Karenina explores both the boon and barbarism of capitalism. Set during the late 1800s, the novel presents Russian peasants and workers displaced by industrialization and land reform. Even the middle and upper-crust characters are constantly talking about money – who owes them, whom they owe and how to get more money.

“The Anna Karenina Principle” is a market theory based on the first line of the book, “Happy families are all alike; every unhappy family is unhappy in its own way.”

For the Anna Karenina Principle, substitute “economies” for “families.” Happy economies are all alike; Every unhappy economy is unhappy in its own way.

Open Veins of Latin America by Eduardo Galeano

The “veins” in Open Veins of Latin America refer to the rich resources in the continent, such as gold and silver, cacao and cotton, rubber and coffee, fruit, hides and wool, petroleum, iron, nickel, manganese, copper, aluminum ore, nitrates and tin, all exploited by America and Europe.

Open Veins of Latin America is a reminder of the way developing nations’ potential prosperity is drained away by the global north, buoying them at the expense of the global south.

Bad Blood by John Carreyrou

Bad Blood tracks the breathtaking rise and shocking collapse of one-time multibillion-dollar biotech startup Theranos, founded by Elizabeth Holmes. More smoke-and-mirrors than true technology, Theranos had marquee names on its board like George P. Shultz. The story of Theranos is a reminder of the Silicon Valley personality cults and inflated tech valuations. They sometimes come crashing down to earth, as in the dot-com tech bubble bust of 2001.

Reading the current-day Silicon Valley excesses gets you wondering – are we in the midst of a new tech bubble?

The New Jim Crow by Michelle Alexander

For some groups like the formally incarcerated, there is never an economic recovery. The New Jim Crow looks at the reality of the formerly incarcerated for whom employment discrimination, housing discrimination, denial of the right to vote, denial of educational opportunity, denial of food stamps and other public benefits, and exclusion from jury service are all legal.

Author Alexander says, “We find ourselves in this dangerous place not because something radically different has occurred in our nation’s politics, but because so much has remained the same.”

Lilli de Jong by Janet Benton

Q: What gives a resource value?

A: Demand; short supply; exclusive supply

This definition might make you think of diamonds, but probably not breast milk.

Breast milk, in this fascinating historical novel, is the economic resource through which a class of impoverished women make their living as wet nurses. At a time before pasteurizing made cow milk safe for babies, main character Lilli de Jong is paid, fed and maintained solely for the purpose of nourishing the child of a rich family – at the expense of her own child’s need for sustenance. The novel is a new take on how women’s value is often literally attached to their bodies.

(Feature image courtesy of @bibliobibuli.c)

*Disclosure: The links above are affiliate links. These picks are editorially selected, but if you purchase, She Reads may get something in return. We are a participant in the Bookshop Affiliate Program, an affiliate advertising program designed to provide a means for us to earn fees by linking to Bookshop.org while simultaneously supporting local bookstores.

Leave A Comment